About Microfinance

Poor people use money. While the amounts may be small, the importance of each transaction is usually much greater than it is to more wealthy individuals. Poor people, therefore, like everyone else, need access to financial services to allow them to borrow and save money to run their businesses and invest in improvements. Like everyone else they have personal expenses such as school fees or wedding celebrations. The informal financial services they have access to can be unsafe and expensive. While there is a long history of self managed informal savings and credit that poor people have devised to meet these needs, such schemes are difficult to manage effectively, and often lack the capital required. In the late 20th century a more systematic, externally managed approach has emerged to support these needs, which has become known as microfinance .

Microfinance schemes were developed to give poor people access to savings and credit services at a reasonable cost, where such services were not being supplied by the formal or informal financial system. Despite great initial skepticism, microfinance institutions (MFIs) have managed not only to defy their critics in the formal banking sector, but to out-perform commercial banks in the areas of volume lending and on-time repayment. Thus they have become a powerful tool for poverty alleviation.

Characteristics of Successful Microfinance Schemes are:

- The service focused upon client needs and capacities.

- Clients enjoy positive incentives for participation in savings schemes and for timely loan repayment.

- Services are provided at or near client’s homes or workplaces.

- The cost of microfinance services enables prices that are able to undercut the existing informal money market (e.g. traditional moneylenders).

- Collateral to support borrowing is often not required.

- Credit products offer a manageable schedule of repayments that are appropriate to the cash flow of clients.

- Financing terms and conditions are tailored to suit individual needs as much as possible. This is becoming particularly noticeable in areas where microcredit supply is high and programs begin to compete for clientele.

- Transparency: objectives are clear, and significant efforts are made to ensure that the rules are known to all clients, as well as being universally and consistently applied. Thus, staff and clients must have the same understanding of program objectives and regulations.

- Because of the large number of small transactions, the organisational operating procedures are simple and efficient in order to control costs and to reduce transaction costs to clients .

- The use of rigorous performance analysis, strong management systems, internal controls and auditing of MFIs.

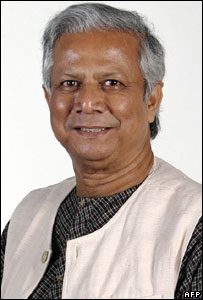

2006 Nobel Peace Prize ...

Muhammad Yunus of Bangladesh, one of the pioneers of microfinance, and the Grameen Bank have been jointly awarded the 2006 Nobel Peace Prize.

To know more about Microfinance...